Last Updated on May 13, 2024

First of all: Do you need travel insurance?

The short answer is YES.

I can’t stress enough how important it is to have travel insurance – receiving a hefty bill after a 5-minute hospital visit in the U.S. taught me and my girlfriend our lesson of traveling without sufficient insurance cover. While there are many countries that provide super cheap health care (we paid $10 for a hospital visit in India, including x-rays, medicine and a 4-hour stay!), other countries (especially the U.S. and most European countries) can cost a big chunk of your travel budget. I always say: If you don’t have the money to buy travel insurance, you shouldn’t go on a trip – because how are you going to cover your expenses in the case something happens?

And travel insurance isn’t only covering your health, but also your belongings. And in a time when everyone is traveling with electronic equipment – be it a Kindle, an iPhone, a laptop or an expensive GoPro, it’s well worth paying to have peace of mind while on a trip.

Which travel insurance do I use?

I have used World Nomads travel insurance for a few years now, since it is the best option for long-term travelers. World Nomads is available to people from over 150 countries and is designed for adventurous travelers with cover for overseas medical, evacuation, baggage and a range of adventure sports and activities.

I’ve found that several of the insurance companies I looked into that offer protection for long-term trips only offer it when you sign up for it before you start your trip, but not while you’re already on it. World Nomads on the other hand also lets you buy a policy when you’re already on your trip (there is a 72-hour waiting period though once you sign up – so do not wait until there’s an emergency to sign up, this will not cover you.)

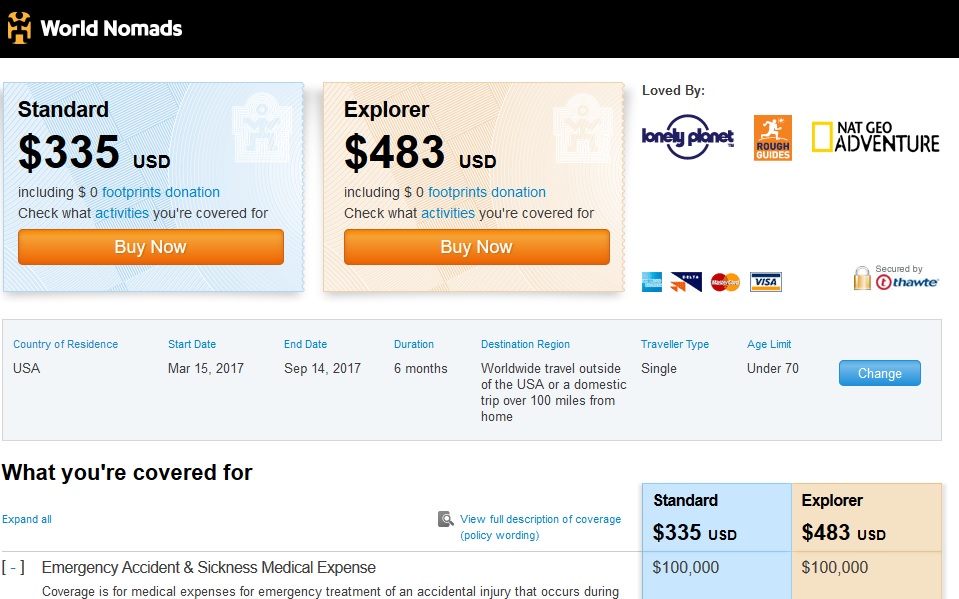

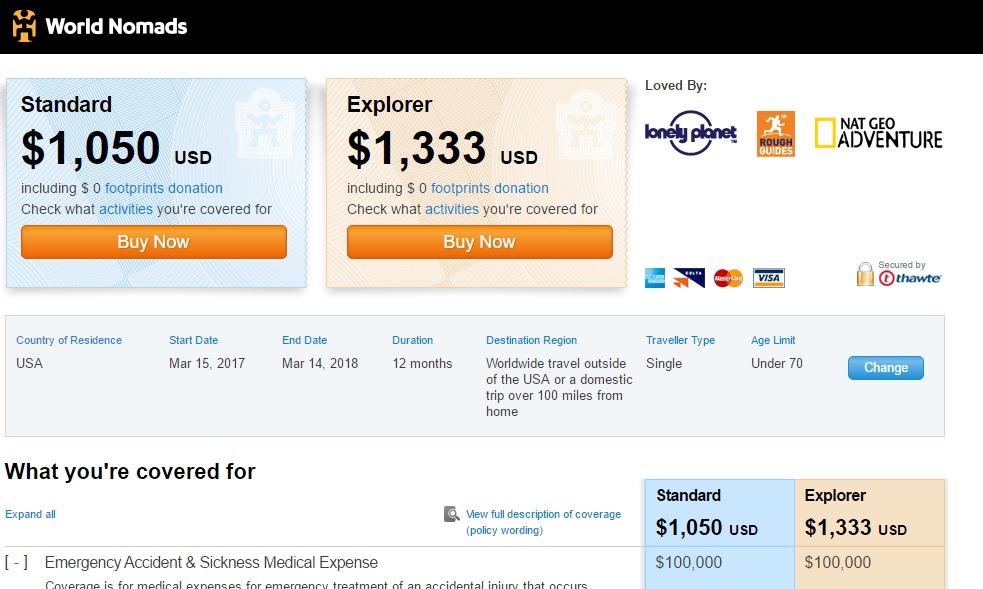

What I also like about World Nomads is that I can choose between two options when signing up for an insurance policy: the Standard and the Explorer option. The main difference between those two is higher coverage for emergency evacuation ($500,000 instead of $300,000) and higher coverage in the case of trip cancellation, trip delay and trip interruption. The Explorer option also includes Collision Damage Waiver (reimbursement for rental car damage), which the Standard does not include. The Explorer also includes a whole bunch of activities that isn’t insured under the Standard option, for example: snorkeling, abseiling, base jumping, hot air ballooning, shark cage diving, mountaineering, skydiving, caving, cliff diving, paragliding – so if you consider yourself an adventurous traveler, I recommend going for the Explorer.

Buying your insurance in 6-months installments is cheaper!

Insure your high value items

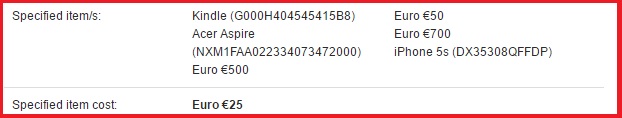

The items are worth about €1.250, and World Nomads gives you the option to insure high value items for up to €1.400.

The items are worth about €1.250, and World Nomads gives you the option to insure high value items for up to €1.400.The high value items insurance also doesn’t cover:

-

- damage to, loss or theft of jewellery, computers, cameras, hand-held and mobile devices or other electronic equipment and any high value specified items if checked in with a common carrier in your baggage.

- theft of computers, cameras, hand-held and mobile devices or other electronic equipment and any high value specified items from a boat or motor vehicle.

High value item insurance for U.S. residents

If you are a resident of the U.S. and would like to insure electronics and other high value items, check out Clements, a global insurance provider for expats and travelers. They also offer health insurance, but I haven’t used them for that (only to insure my electronics), so I don’t know how good their travel insurance is. Their insurance for electronics was very reasonable at around $100 per year (but the exact amount depends on the total value of items you’re looking to insure, my total was around $6,000).

Other travel insurance options

If you don’t like World Nomads for whatever reason, here are some other options for travel insurance:

Europeans

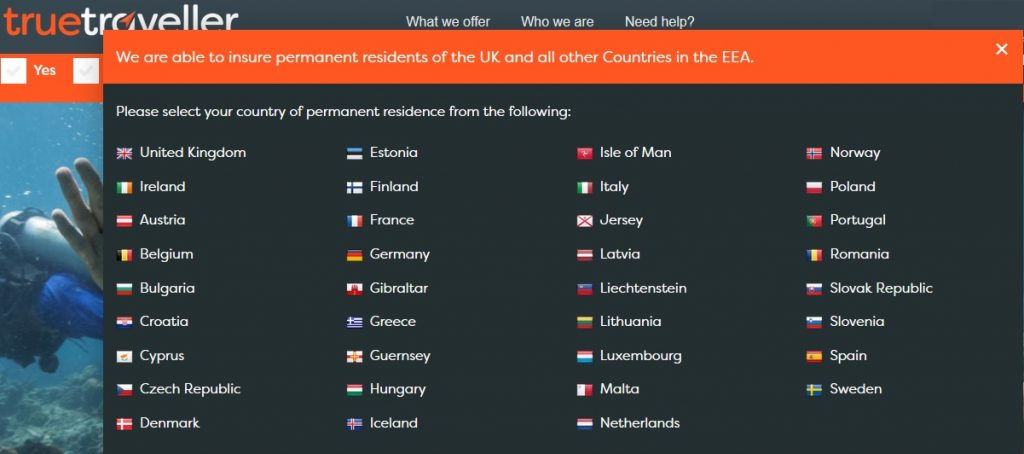

TrueTraveller – offers travel insurance for the following European countries:

Australians

Huddle (travel insurance starting at $3 a day)

Under 30 Travel Insurance for travelers under 30

UK citizens

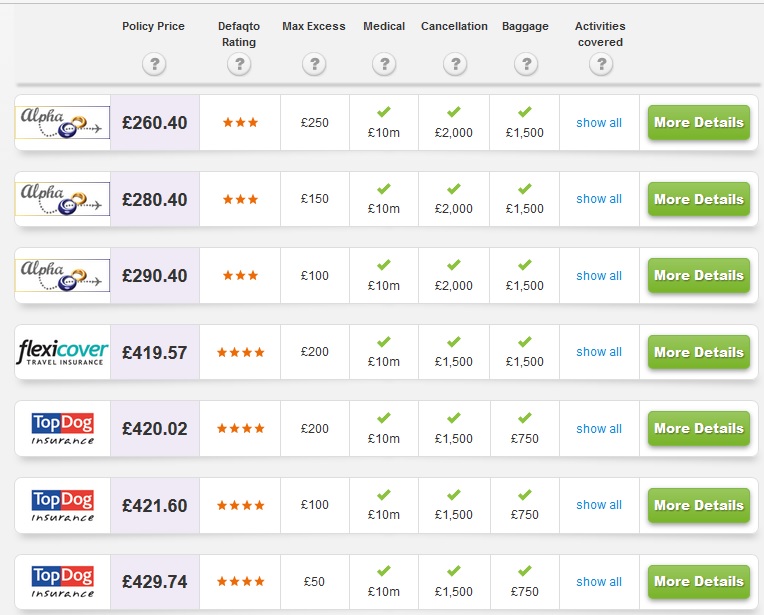

… or do a travel insurance search with MoneySuperMarket and compare their results:

(My test search was for a 1-year backpacking trip)

(My test search was for a 1-year backpacking trip)